What is the Downside of Hedges? Exploring Risks and Limitations in Investment Strategies

In the world of investment, hedges are often lauded for their ability to mitigate risk and protect portfolios from adverse market movements. However, this protective strategy is not without its downsides. While hedging can shield investors from extreme losses, it may also introduce its own set of risks and limitations that demand careful consideration. This article delves into the potential pitfalls of hedging strategies, examining how they can lead to unintended consequences, misallocation of resources, and overconfidence in market predictions. Understanding these drawbacks is crucial for investors seeking to balance risk and reward in their financial endeavors.

Understanding the Drawbacks of Hedges

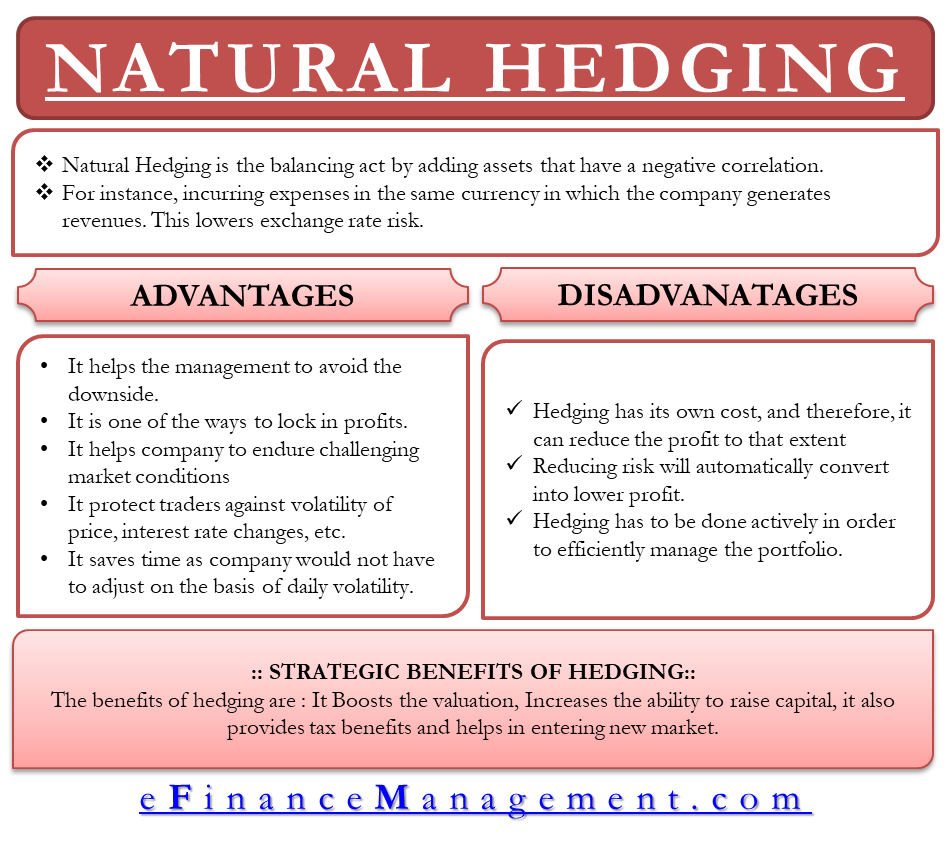

Hedges, while often utilized as a form of risk management to protect investments, come with significant downsides that investors should carefully consider. One major drawback is that hedging can be expensive; the costs associated with purchasing derivatives or entering into futures contracts can erode potential profits. Additionally, hedges may limit upside opportunities, causing an investor to miss out on considerable gains if the market moves favorably. Moreover, improper hedging strategies can lead to increased complexity in investment portfolios, making them harder to manage and understand. Investors may also experience liquidity issues with hedging instruments, as some may not be easily tradable, potentially leading to difficulties in executing exit strategies. Finally, if a hedge is incorrectly assessed or implemented, it can result in financial losses rather than the intended protection.

High Costs Associated with Hedging

The primary downside of hedging comes from the associated costs, which can include premiums for options, fees for futures contracts, and the potential for higher transaction costs. These expenditures can significantly diminish the overall return on investment, especially if the market does not move in a way that warrants the use of the hedge. Consequently, investors must weigh the costs against the potential benefits, particularly in less volatile markets where the need for a hedge may be minimal.

Limited Upside Potential

Hedging strategies inherently focus on minimizing risk, which can inadvertently cap the potential profits an investor can realize. When an asset is hedged, any substantial increase in value may be countered by the costs or losses incurred in the hedge itself. For instance, if an investor hedges a stock position thinking it might decline but it surges instead, the profits from the stock may only cover the hedging costs rather than resulting in net gains.

Increased Complexity

Implementing hedging strategies can add a layer of complexity to an investment portfolio, making it more challenging for investors to track performance. This complexity can arise from the need to monitor multiple hedge instruments and their performance in conjunction with the underlying assets. As a consequence, an investor may find it difficult to make informed decisions or appropriately manage their portfolio, leading to potential mistakes in strategy execution.

Liquidity Challenges

Another significant downside to hedges can be liquidity issues. Some hedging instruments, particularly those that are customized or less common, may not have a ready market, making it difficult to exit a position quickly when needed. This lack of liquidity can pose a risk during volatile market conditions, where prompt action may be necessary to mitigate losses, resulting in a situation where the investor may be forced to hold onto fragile positions longer than desired.

Potential for Increased Losses

Improperly executed hedging strategies can lead to financial losses rather than providing the desired protection. If a hedge fails to correlate correctly with the underlying asset, it can result in increased exposure to market volatility rather than decreased risk. This misalignment can be devastating, especially if the market moves aggressively against the investor, leaving them with substantial losses in both the underlying position and the hedge itself.

| Downside Aspect | Description |

|---|---|

| High Costs | Expenses related to hedging can reduce overall returns. |

| Limited Upside | Cap on profits due to hedging strategies. |

| Increased Complexity | More challenging portfolio management and decision-making. |

| Liquidity Challenges | Difficulties in exiting positions quickly when necessary. |

| Potential Losses | Risks of financial losses from poor hedging execution. |

What are the disadvantages of hedges?

The disadvantages of hedges can affect both the effectiveness of risk management strategies and the overall financial outcome of an investment. While hedging is a popular method for mitigating potential losses, several drawbacks accompany its use.

Complexity of Hedging Strategies

The complexity of hedging strategies can be a significant disadvantage. Understanding the different types of hedges—such as options, futures, and forwards—requires extensive knowledge and expertise. This complexity can lead to potential misunderstandings or mismanagement.

- Hedging involves intricate calculations and strategies that can confuse inexperienced traders.

- Misinterpretation of hedge instruments may lead to increased exposure rather than reduced risk.

- The complexity may also deter small investors from engaging in hedging, limiting their options.

Cost Implications

Another downside of hedges is the financial costs involved. Implementing a hedging strategy can lead to substantial transaction costs, including fees for executing trades and maintaining positions.

- Hedging often requires capital outlay, affecting liquidity.

- Costs can accumulate over time, leading to reduced profit margins.

- In the event of unnecessary hedging, funds could be tied up, leading to lost opportunities in other investments.

Reduced Profit Potential

While hedging aims to protect against losses, it can also cap potential gains. The mechanisms behind hedging often lead to a balance that limits upside performance.

- Hedging can cause partial or complete offsetting of profits when markets move favorably.

- This may discourage investors from pursuing aggressive strategies that could yield higher returns.

- In volatile markets, proactive hedging can lead to missed inflations of asset values.

Psychological Factors

Hedging can also introduce psychological stress among investors. The fear of losses can lead to irrational decision-making, impacting performance.

See also:

- Over-reliance on hedging can create a false sense of security, leading to riskier behavior.

- Investment decisions may become overly conservative, compromising overall growth.

- Fear of loss may prompt unnecessary hedging, fostering a cycle of anxiety-driven choices.

Regulatory and Compliance Challenges

Compliance with regulatory standards can pose challenges for investors using hedges. Different jurisdictions have distinct regulations, potentially increasing complexity and risk.

- Failure to comply with local regulations can lead to penalties or restrictions.

- The dynamic nature of regulations may require continuous monitoring and adjustments.

- Understanding compliance requirements can further hinder investor participation in hedging.

What is the downside risk of a hedge?

The downside risk of a hedge refers to the potential loss a trader or investor may face despite employing a hedge to mitigate risk. While hedging is used to protect against adverse price movements in an asset, it is not without its own pitfalls. Understanding the downside risk of a hedge can help investors make more informed decisions. Here are several key factors to consider:

Understanding Hedge Mechanics

Hedging typically involves taking a position in a financial instrument that is negatively correlated with another asset. The goal is to minimize potential losses from adverse movements. However, the mechanics can introduce new risks:

- Cost of Implementation: Hedging usually incurs additional costs, such as premium payments for options or transaction fees, which could eat into profits.

- Imperfect Hedge: In many cases, a hedge may not perfectly match the exposure, leading to residual risk that can still result in losses.

- Market Movement: If the market moves favorably for the hedged position but unfavorably for the hedge, the investor can experience a net loss.

Potential for Reduced Returns

While hedging serves to limit losses, it also has the potential to diminish overall returns. This occurs when:

- Opportunity Cost: Capital tied up in hedging instruments may not be available for other higher-yielding investments.

- Reduced Upside: If the market turns favorable, the gains from the primary asset may be offset by the costs or losses in the hedge.

- Psychological Factors: Investors may become overly reliant on hedges, leading to complacency and decreased vigilance in managing their investments.

Liquidity Risks

Some hedging instruments may lack adequate liquidity, which presents risks such as:

- Difficulty Exiting Positions: Investors may find it challenging to close or adjust hedge positions in volatile markets, leading to unintended consequences.

- Wider Bid/Ask Spreads: Low liquidity can result in wider spreads, increasing the cost of entering and exiting trades.

- The Mark-to-Market Risk: In illiquid markets, price adjustments may lead to significant fluctuations in the value of the hedge, causing potential loss.

Counterparty Risks

When hedging involves derivatives or other contracts, it introduces counterparty risk, which includes:

- Default Risk: If the counterparty fails to fulfill the contract, investors could lose their hedge protection.

- Creditworthiness: The financial health of counterparties can change, impacting the reliability of the hedge.

- Legal Risks: Disputes may arise regarding contract terms, complicating the hedge and leading to financial loss.

Regulatory and Tax Implications

Hedging strategies may also be affected by various regulatory and tax considerations, which can pose risks such as:

- Compliance Costs: Investors may incur significant costs to ensure compliance with relevant regulations affecting their hedging practices.

- Tax Liabilities: Certain hedging activities could lead to unexpected tax consequences that may diminish net returns.

- Changes in Regulation: Regulatory environments can evolve, potentially making certain hedging tactics less effective or even obsolete.

Are hedges bad for the environment?

Hedges can be a topic of discussion when it comes to their impact on the environment. While they have some benefits, such as providing habitats and acting as windbreaks, they can also contribute negatively to ecosystems in certain contexts. Here are some points to consider regarding whether hedges are bad for the environment.

Impact on Biodiversity

Hedges can play a significant role in promoting biodiversity, but they can also have adverse effects, particularly when they are non-native species.

- Habitat Creation: Native hedges offer shelter and food for various wildlife, helping to maintain local ecosystems.

- Invasive Species: Non-native hedge species can disrupt local flora and fauna, outcompeting indigenous plants and altering habitats.

- Fragmentation: In areas where hedges are systematically trimmed or removed, wildlife can lose connectivity, leading to population declines.

Soil Health and Erosion

Hedges can influence soil quality, both positively and negatively, depending on their composition and management.

- Soil Stabilization: The root systems of hedges can help prevent soil erosion, particularly on slopes and vulnerable areas.

- Nutrient Cycle: Leaf litter from hedges can enrich soil through natural decomposition, promoting healthier ecosystems.

- Compaction Issues: Over-manicured hedges may lead to soil compaction, hindering water infiltration and negatively affecting soil organisms.

Water Management

The interaction between hedges and water management is crucial for environmental health.

See also:

- Surface Runoff Reduction: Hedges can help slow down water runoff, reducing soil loss and promoting groundwater recharge.

- Water Usage: Some hedges may consume significant water resources, especially in drier climates, impacting local water tables.

- Pollution Filtration: Hedges can act as buffers, filtering pollutants from agricultural runoff before they enter waterways.

Carbon Sequestration

Hedges can contribute to reducing atmospheric carbon dioxide through carbon sequestration, but effectiveness varies.

- Carbon Storage: Mature hedges store significant amounts of carbon in their biomass, contributing positively to climate change mitigation.

- Growth Rate: Fast-growing species sequester carbon more rapidly, while slow-growing hedges have less immediate impact.

- Maintenance Practices: Regular trimming and poor management can negate the carbon storage benefits of hedges.

Human Interaction and Management

How hedges are managed and maintained significantly affects their environmental impact.

- Pesticide Use: Chemical treatments can harm beneficial insects and disrupt local ecosystems, leading to negative environmental consequences.

- Over-Trimming: Excessive pruning can destroy habitat quality and reduce the hedge's ecological value.

- Community Engagement: Involving local communities in hedge management can enhance biodiversity and promote sustainable practices.

Are hedges difficult to maintain?

Hedges can be both a beautiful and a functional addition to any landscape, providing privacy, defining property lines, and even acting as windbreaks. However, the maintenance of hedges can vary significantly depending on several factors, making them a potential challenge for many homeowners.

Maintaining hedges may involve regular tasks such as pruning, watering, pest control, and fertilization. These tasks ensure the healthy growth of the hedge and the prevention of diseases or infestations. The ease or difficulty of these tasks can depend on the species of the hedge, its growth rate, and the environmental conditions in which it is grown.

Below are some essential aspects to consider regarding the maintenance of hedges.

1. Species Selection

Choosing the right species for your hedge is crucial, as different plants have varying care requirements. Some hedges grow quickly and require frequent maintenance, while others grow slowly and may need little attention.

- The growth rate of the species influences how often you'll need to prune.

- Some species are more resistant to pests and diseases, making them easier to care for.

- Consider the climate of your area; some plants thrive better in specific conditions.

2. Pruning Techniques

Proper pruning is essential to maintain the health and shape of hedges. Performing this task correctly can significantly affect the ease of other maintenance activities.

- Regular pruning helps maintain the desired shape and size of the hedge.

- Improper pruning can lead to weak growth or an unattractive appearance.

- Learning the correct techniques can reduce the overall amount of time spent on maintenance.

3. Watering Requirements

Different hedges have varying water needs based on their species and growth stage, which can impact maintenance frequency.

- Newly planted hedges often require more frequent watering until established.

- Consider using mulch to retain moisture and reduce watering needs.

- Understanding the soil type will help you determine how much water is necessary.

4. Pest and Disease Management

Hedges can attract pests and may be susceptible to diseases that can complicate maintenance. Being proactive in management is key to keeping them healthy.

- Regularly inspect your hedges for signs of infestations or diseases.

- Consider the use of organic pesticides if problems arise.

- Healthy plants are generally more resistant to pests and diseases.

5. Seasonal Considerations

Seasonal changes influence the growth and maintenance of hedges, dictating the timing of various care activities.

- Different seasons may require different care techniques, such as winter protection.

- Timing your pruning and fertilization to the growth cycle is important.

- Seasonal weather patterns can affect the water needs of your hedges.

Questions from Our Readers

What are the primary downsides of using hedges in investment?

The primary downsides of using hedges in investment include cost, as implementing hedging strategies often involves paying premiums for options or other financial instruments. Additionally, hedges can lead to reduced profits; if the market moves in a favorable direction, the gains may be offset by the hedge, resulting in lower overall returns.

How can hedges affect liquidity?

Hedges can affect liquidity since certain hedging instruments may not be as easily tradable as other assets. This can lead to challenges in entering or exiting positions quickly, potentially increasing the transaction costs and making it more difficult to react to market changes.

See also:

What is the impact of hedges on portfolio performance?

The impact of hedges on portfolio performance can be mixed; while they can provide protection against losses, they can also limit potential gains. If markets perform well, the costs associated with hedging can diminish overall returns, making it essential to carefully consider the balance between risk reduction and profit potential.

Do hedges introduce additional complexities to investment strategies?

Yes, hedges introduce additional complexities to investment strategies. Understanding the various types of hedging instruments and how they interact with different market conditions requires a higher level of expertise and can lead to mismanagement if not properly executed, complicating the overall investment process.

If you want to read more articles like What is the Downside of Hedges? Exploring Risks and Limitations in Investment Strategies, we recommend you check out our Hedges category.

Leave a Reply

Related Articles